Is AI Responsible for Denied Claims?

Providers Note Costly Rise in

Medical Claim Denials

Dr. Nick van Terheyden knew something was fishy.

When his own physician ordered bloodwork to diagnose the cause of van Terheyden’s bone pain, both of them fully expected his insurance plan to cover the cost. But instead, Cigna denied the medical claim as “not medically necessary.”

Dr. van Terheyden realized that was not right. His suspected vitamin D deficiency could lead to osteoporosis if left untreated. The vague wording of the claim denial indicated to van Terheyden that Cigna’s medical director, Dr. Cheryl Dopke, had not actually reviewed the case.

As it turned out, van Terheyden’s file was only one of 60,000 that Dopke denied in a single month in 2022.

Other Cigna medical directors have done the same – one issued more than 80,000 instant denials during the same time frame. Over a two-month period in 2022, Cigna doctors denied more than 300,000 claims, spending an average of 1.2 seconds on each case.

Automated Bulk Denials

The health insurance giant is now embroiled in a massive class-action lawsuit that alleges Cigna uses a computer algorithm to automatically deny hundreds of thousands of medical claims without examining them individually as required by California law.

(See sidebar, “About PxDx.”)

About PxDx

Cigna's claims review system PxDx (corporate shorthand for procedure-to-diagnosis) was developed more than a decade ago by former pediatrician Alan Muney, who now advises insurers on how to save costs.

PxDx involves a list of tests and procedures approved for specific illnesses. The program would automatically deny payment if a treatment did not match a listed condition. Denials were then sent to Cigna medical directors, who would reject these claims without reviewing the patient file.

Muney and his team previously worked for United Healthcare, where they devised a similar system that allows UHC doctors to bulk-deny claims quickly.

Source: Propublica

The plaintiffs seek "statutory and punitive damages," costs and attorneys' fees, and "appropriate declaratory and injunctive relief enjoining Cigna from continuing its improper and unlawful claim handling practices."

Former Cigna employees have stated that the vast majority (about 99.8%) of patients will pay the denied claims rather than deal with the hassle of an appeal.

UHC's Legal Woes

Cigna is not the only insurance provider using artificial intelligence to issue bulk denials. United Healthcare (UHC) is battling a class-action suit claiming the company knowingly used a faulty AI algorithm to deny elderly patients coverage for medically necessary extended care.

The families of two deceased patients argue that UHC deployed AI technology known to have a 90% error rate (called "nH Predict") to deny medically necessary care to seniors. The plaintiffs also stated the insurer expected only a fraction of policyholders to appeal the denied claims, knowing patients would either pay out-of-pocket costs or forgo the remainder of their prescribed care.

They are seeking monetary damages.

Denied Claims on the Rise

In 2021, insurance companies denied about three percent of all medical claims (and 17 percent of all in-network claims) filed. In 2022, that figure rose to 11 percent, representing 110,000 unpaid claims for each average-sized healthcare system.

These denial rates are not likely to decline any time soon. According to the latest Experian Health data, 30 percent of healthcare leaders say that claims denials are increasing by 10 to 15 percent.

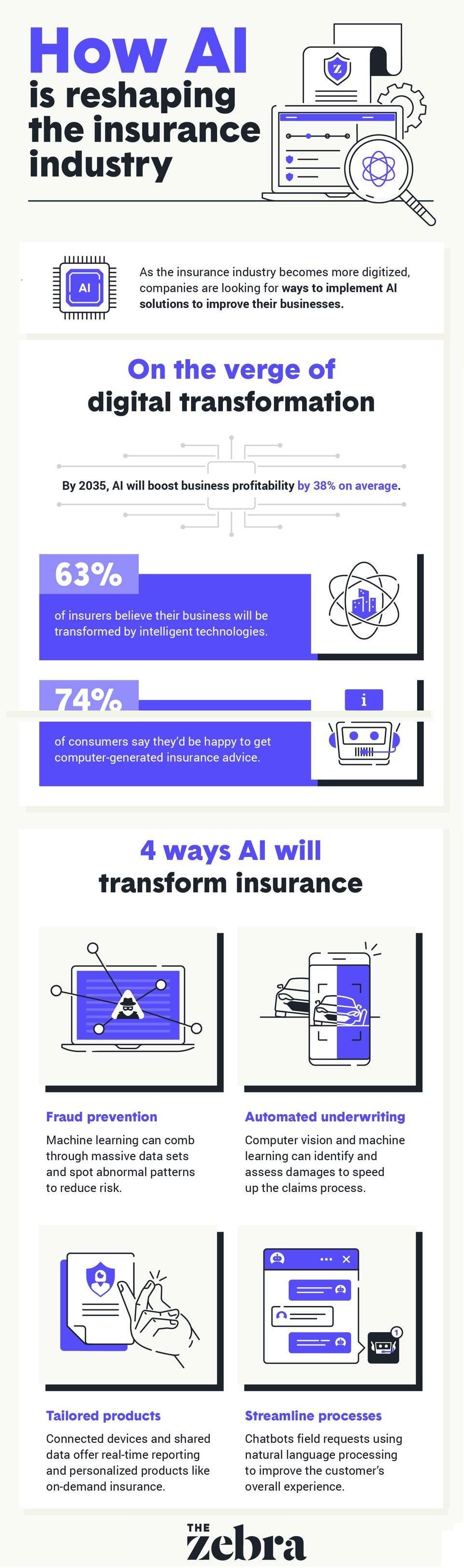

Legal experts anticipate more insurers will encounter similar complaints as they increasingly incorporate AI in their claims management processes. Medical professionals also advise health insurers to rein in their expectations of AI's utility.

Last year, the American Medical Association (AMA) cautioned health insurance companies to require human examination of patient records before denying medical claims. "AI is not a silver bullet," said AMA Board Member Marilyn Heine, MD.

--Article Continues Below--

How to Fight Autogenerated Denials

What can medical practitioners do about bulk AI-generated claims denials? Dr. John Lin, an Arizona urologist, offers the following advice:

- Understand payer policies and rules to secure prior authorization for procedures properly. Keep track of which payers will pay for which procedure using which diagnosis.

- Always appeal the denial. If your billing is outsourced, check with the billing company to ensure they aren't automatically writing off denied claims. Open communication with the coding and billing staff is vital to an effective and timely appeal.

- Finally, if a particular payer continues to play games with your medical practice, Dr. Lin suggests you hit them where it hurts:

The Rest of van Terheyden's Story

After a second Cigna doctor insisted that van Terheyden's blood test was unnecessary and again denied the claim, he took the matter to an independent reviewer, as allowed by his insurance plan.

Seven months after van Terheyden's procedure, the external physician determined that "This patient is at risk of bone fracture without proper supplementations. Testing was medically necessary and appropriate."

Sources:

Featured Image: Adobe, License Granted

Medical Economics

Propublica

U.S. PIRG Education Fund

Experian

RevCycle Intelligence

Modern Healthcare

Recent Posts

Share On: