Let’s Talk: Communicating With Consumers in Default

How to Make Collection Calls

Less Daunting

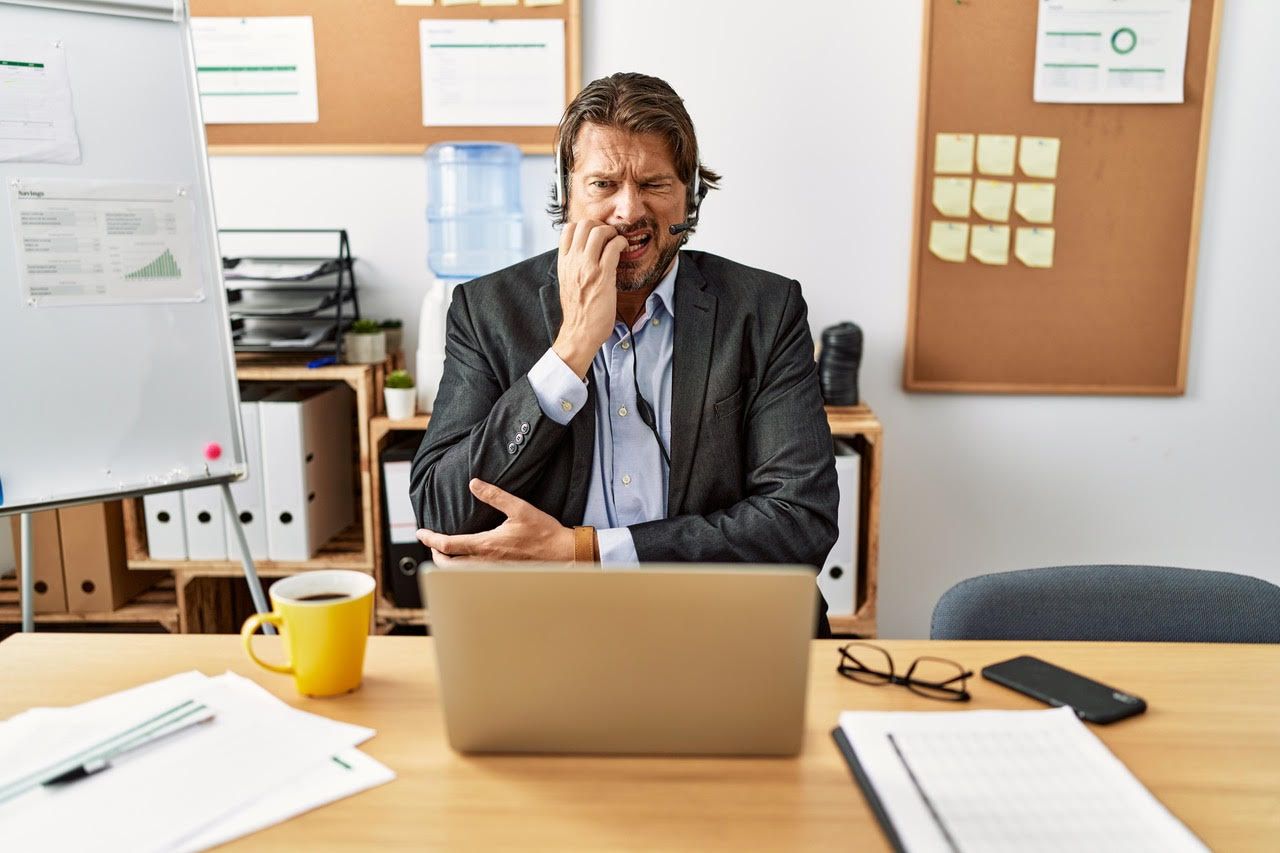

A young woman had fallen upon hard times and missed a payment on an overdue debt. So she called the collection agency in order to work out an adjustment to her repayment plan.

But rather than receive compassion or empathy, the debt collector berated her. “You need to figure out how to pay it right now," she was told.

Because the young woman had nothing to offer besides grocery money, she asked if the payment could be deferred until she received her next paycheck. She was told that was “unacceptable.”

The conversation went downhill from there. It finally ended with the collection agent screaming, “What the heck is wrong with you?! [Only she didn’t say “heck.”] You need to pay this debt! If you can’t work with us, we’ll take you to court!” Then she hung up.

This nightmare true story is a shocking example of how NOT to handle a collection call. Let’s explore some more reasonable and effective techniques.

Have a Plan

Collection calls are not easy. The collector must work to maintain (or rebuild) trust while seeking a resolution that meets the needs of both parties. This process cannot be approached haphazardly; it requires a plan.

Regulation F

Restrictions

Regulation F, a revision to the Federal Debt Collection Practices Act (FDCPA) which became effective last November, places the following restrictions on the number of times debt collectors may attempt to call consumers:

- Collectors may not attempt to call more than seven times within seven consecutive days. Any call that is placed and connected is considered an attempt to call, including voicemails, ringless voicemails, and limited-content messages.

- Collectors are limited to one debt-related conversation with a consumer within a seven-day period.

First of all, an effective collection process uses multiple channels (phone, text, email) over a period of several weeks. The key is to persist without becoming overly intrusive.

Attempting multiple contacts every day, or utilizing aggressive automated dialing campaigns, will not only backfire, it could be illegal. (See sidebar, "Regulation F Restrictions.")

While it’s true these tactics can result in an occasional payment, the risk of damage to the consumer relationship – as well as the risk of noncompliance – is simply too great.

Different people will respond differently to your attempts to contact them. Some will readily work with you to resolve the unpaid account. Others may be evasive, irate, or scared (maybe even abusive).

It’s important to keep in mind that the vast majority of patients and consumers want to pay their bills. It’s your job to help them do just that.

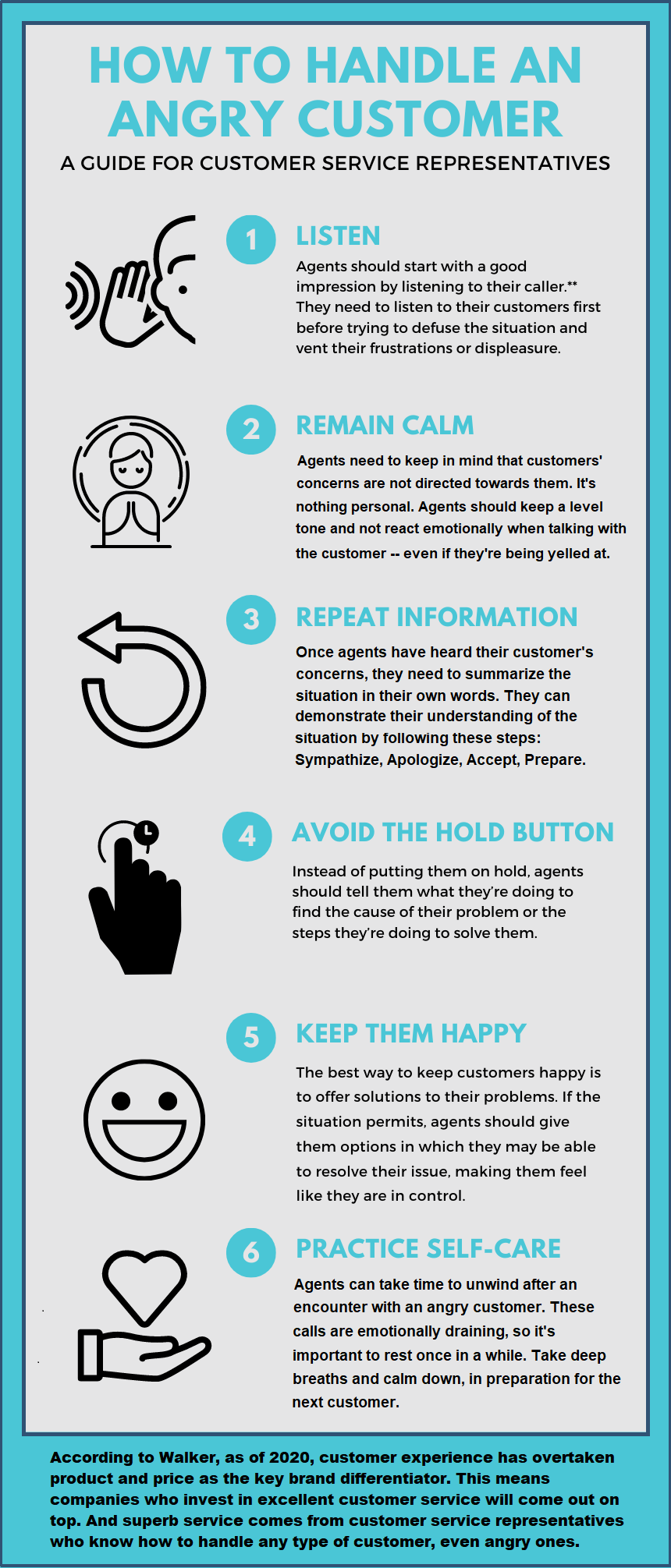

Defusing an Argument

What should you do if you encounter an angry or hostile consumer?

First of all, resist the temptation to retaliate! Try to defuse the situation instead. The following strategies have proven helpful:

Let ′Em Vent

Allowing consumers to vent their frustrations does not mean you’re losing control of the conversation. Rather, it’s an intentional means of defusing their anger in order to move toward your goal of payment. Sometimes people just want someone to listen.

Don’t argue with patients or try to prove them wrong. Tell them you understand how exasperating things can be.

Four Tips for

Empathetic

Listening

- Be nonjudgmental.

- Give the consumer your undivided attention.

- Listen to both facts and feelings.

- Restate and paraphrase.

Source: Crisis Prevention Institute

Admit Mistakes

If a consumer is angry because of a situation due to an error on your end, own up to the mistake. Then apologize. A simple apology may catch them off guard and neutralize their hostility. Then you can proceed to correct the error (or at least, begin the correction process).

Acknowledge Their Value

Long-term patients or other customers need to know how much you appreciate them. If the patient has a history of paying on time, tell them how much you value that. Help them feel important. Most people are not inclined to argue with someone who’s validating their worth.

Perfect the Process

Once you have a process in place, it’s important to continually review and revise it, based on any data you can gather.

Then, don’t hesitate to make adjustments as needed.

For example, you might need to alter the content of your communications, the communications channel you’re using, or the types of repayment terms you offer. Flexibility is key. Be aware that successfully identifying the strategies and techniques that work best for you and your patients may take some time.

Send in the Cavalry

Are your internal A/R staff members at their wits’ end attempting to collect on overdue accounts? Do you think they may be doing more harm than good? If so, it’s time to bring in the pros.

--Article Continues Below--

CBSI’s respectful, solution-focused services produce far better results than harsh demands. Our in-house compliance officer is continually reviewing our processes. And our custom-made compliance management system ensures we’re always current with the ever-changing regulatory environment.

Knowing the best way to communicate with your consumers in default is what we do.

Problem solved.

Sources:

Featured Image: Adobe, License Granted

Entrepreneur

InsideARM

PDC Flow

Recent Posts

Share On: