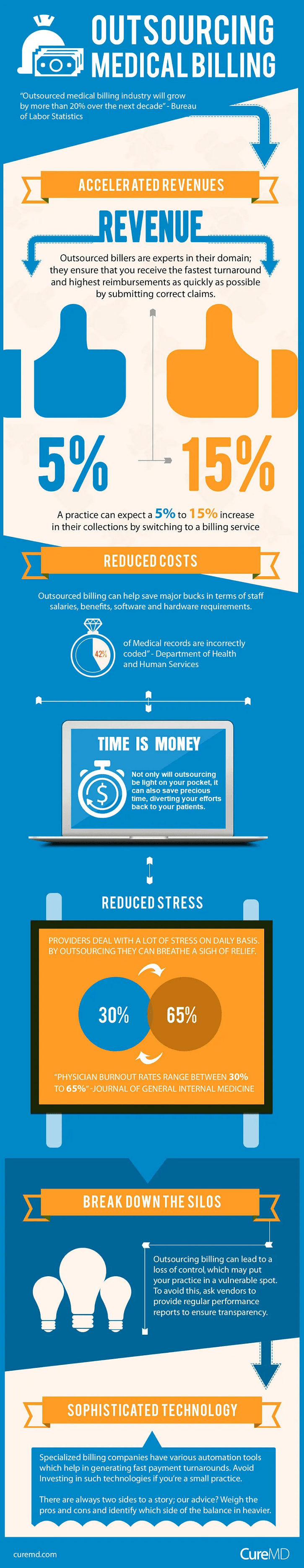

Medical Claim Denials Continue to Climb

How to Prevent Denied Claims

Medical claim denials increased by 17% in 2021.

According to the most recent Medical Group Management Association (MGMA) poll, nearly 70% of healthcare leaders cite the rise in denials, indicating that the pandemic has caused more rejections. In 2020 a

Healthcare Revenue Cycle Denials Index

revealed that claim denials had climbed by 23% over the previous four years. That analysis examined more than 102 million claims submitted by 1,500 U.S. hospitals.

The highest denial rates were concentrated in two regions that were hardest hit by the pandemic – the Northeast and the Pacific coast.

Pre-Pandemic Problem

Although the pandemic has aggravated the problem, the increase in medical claim denials began before the COVID outbreak, according to 2019 data. An American Hospital Association (AHA) 2020 report confirmed that 89% of hospital administrators had witnessed an increase in denied claims over the last three years. About half of those respondents described the increase as “significant.”

According to the AHA, claim denials not only impact revenue performance for care providers, they also affect the quality and accessibility of patient care.

(

See box below, "Claims Denials Fueling Burnout.")

Preventable Issues

Eighty-five percent of the denied medical claims are potentially avoidable, the research suggests. Even worse, according to studies by Change Healthcare, 48% of revenue lost from these denials are not recoverable.

Claims Denials

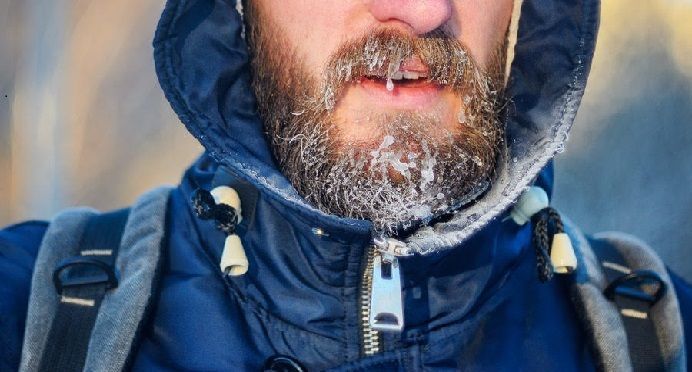

Fuel Burnout

More clinicians are experiencing burnout because private health insurance carriers abuse practices such as prior authorization and medical claim denials, according to a pre-pandemic American Hospital Association (AHA) survey.

The survey asked more than 200 hospitals and healthcare systems, including several hundred executives, about the ways in which claims denial practices and pre-certifications impact their operations.

In addition, since 2020, COVID-related staffing shortages have made these issues "increasingly urgent," an AHA spokesperson said.

Source:

Becker's Hospital Review

The largest portion of those claims are denied because of inaccurate or incomplete data, insufficient explanation of benefits, and incorrect or incomplete prior authorizations.

In other words, this revenue loss was preventable.

Why Are Claims Denied?

Insurance carriers usually deny claims for the following reasons:

No Prior Authorization

Failure to obtain prior authorization for treatment is one of the top reasons for claim denial, according to the AHA. Staff members who are responsible for submitting insurance claims must know which insurance carriers require prior authorization for which treatments.

Pre-certification requirements impose a significant burden on medical offices. According to the American Medical Association (AMA), 86% of physicians’ offices rate the burden of prior authorization as “high” or “extremely high.” Offices typically must devote two business days per week just to addressing these requirements.

Inadequate Information

Another common mistake that leads to denied claims is providing inadequate information to the insurance carrier. Omitting the smallest detail (such as demographic information, treatment date, or date of onset) can result in claim denial.

Coding Errors

Referring to an obsolete codebook, or otherwise using incorrect codes occurs often.

The result is a denied claim and lost revenue. Failure to provide proper documentation when coding and submitting claims can cause insurance companies to assume the services were not performed.

Duplicate Billing

Whenever a staff member fails to remove a claim from a patient’s account after it has been resubmitted, duplicate billing is often the result. Duplicates are usually detected and flagged by claims processing systems; if the original claim is identified as a duplicate, the claim could be denied.

So simply preventing duplicates is not enough. Original claims need to be properly coded with the required modifiers and documentation so that the bill is identified as an original.

--Article Continues Below--

Bad Timing

Even when the claim is legitimate and properly coded, it can still be denied if it’s not submitted in a timely manner. (For example, did you know the Affordable Care Act reduced the deadline window for submitting Medicare claims from 15-27 months to 12 months after the date of service?)

Furthermore, different insurance carriers have different deadlines. If you fail to meet these defined deadlines you’ll lose some serious revenue.

No Coverage Verification

Health insurance is continually changing all the time. Which means coverage eligibility must be verified every time medical services are provided. Tedious? You bet. But doing so could save your practice a significant amount of money down the line.

Sources:

Featured Image: Adobe, License Granted

RevCycle Intelligence

American Hospital Association

Becker's Hospital Review

Right Patient

Recent Posts

Share On: