New Credit Reporting May Not Include Medical Debts

Have You Noticed a Change

in Credit Reporting?

In recent years, some consumers have noticed that medical debt is not showing up on their credit reports. Why is this?

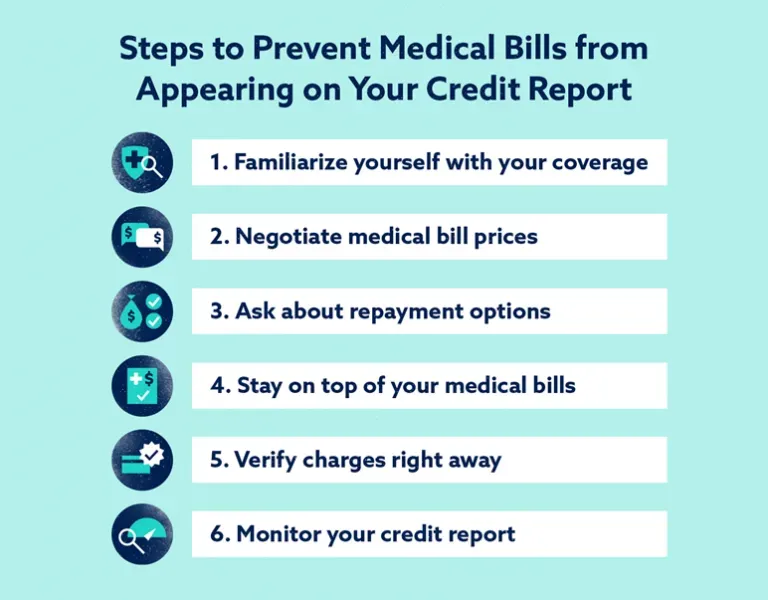

Because credit agencies have changed the way they report and evaluate medical indebtedness. As of September 2017, all three major credit reporting agencies -- Experian, Equifax and TransUnion – now set a six-month waiting period before they include medical debt on a consumer's credit report. This grace period is intended to ensure that consumers have sufficient time to resolve any disputes with insurers or delays in payment.

Not only that, but credit bureaus are also required to remove a medical debt if the amount has been paid -- or is being paid -- by insurance. (Credit scoring formulas do not typically penalize medical debt that's been paid by the consumer, although the debt may remain on the credit report.)

--Article Continues Below--

Source: Lexington Law

A Step Forward

According to Julie Kalkowski, executive director of the Financial Hope Collaborative, the six-month waiting period is "a big step forward toward a more equitable process." She believes the new process prevents accounts from being sent to collections too soon.

"Without a standardized process, some bills get sent to collections because they're 30 or 60 days past due, as opposed to six months," Kalkowski said.

At least 43 million Americans have medical debt in collections, according to the Consumer Financial Protection Bureau. And the average amount of medical debt in collections is $579, compared with $1,000 for non-medical debt.

In addition, more than half of Americans with medical debt (about 15 million consumers) have no other debts listed on their credit reports.

Much of this debt is the result of high-deductible health plans and significant out-of-pocket financial responsibilities for health care, according to Chad Mulvany, policy director at Healthcare Financial Management Association. These debts often arise from hospital stays, ambulance services, or out-of-network doctors who consumers thought were in-network. "More people who typically would have been a good credit risk are now saddled with big bills,” Mulvany said.

Changing the Formula

Credit-scoring companies -- like FICO and VantageScore -- build algorithms based on credit report data to assign the consumer’s three-digit credit score, were higher scores indicate lower risk.

Because of the recent changes, these companies have adjusted their formulas to account for the fact that medical debt is no longer an accurate predictor of whether someone is a good credit risk.

In fact, according to Ethan Dornhelm, vice president of scores and analytics at FICO, "Those with medical accounts are less likely to default on their accounts than non-medical accounts."

As a result, newer FICO and VantageScore models now differentiate between medical and non-medical debt. At VantageScore Solutions, medical collections receive a smaller penalty than non-medical collections, said senior vice president Sarah Davies.

This change often makes a difference in people's credit scores. For instance, under FICO’s newest model, a consumer whose only major credit blot is one or more medical collections would see a median score increase of roughly 25 points over older versions, said Dornhelm.

We Know the Rules

When it’s time to send your medical accounts to collections, you'll want to select an agency that's well-trained in complying with the latest guidelines and regulations. Trust the collection professionals at CBSI to handle all your medical account receivables with the utmost care, within strict compliance, and without ever jeopardizing your precious patient relationships.

Recent Posts

Share On: