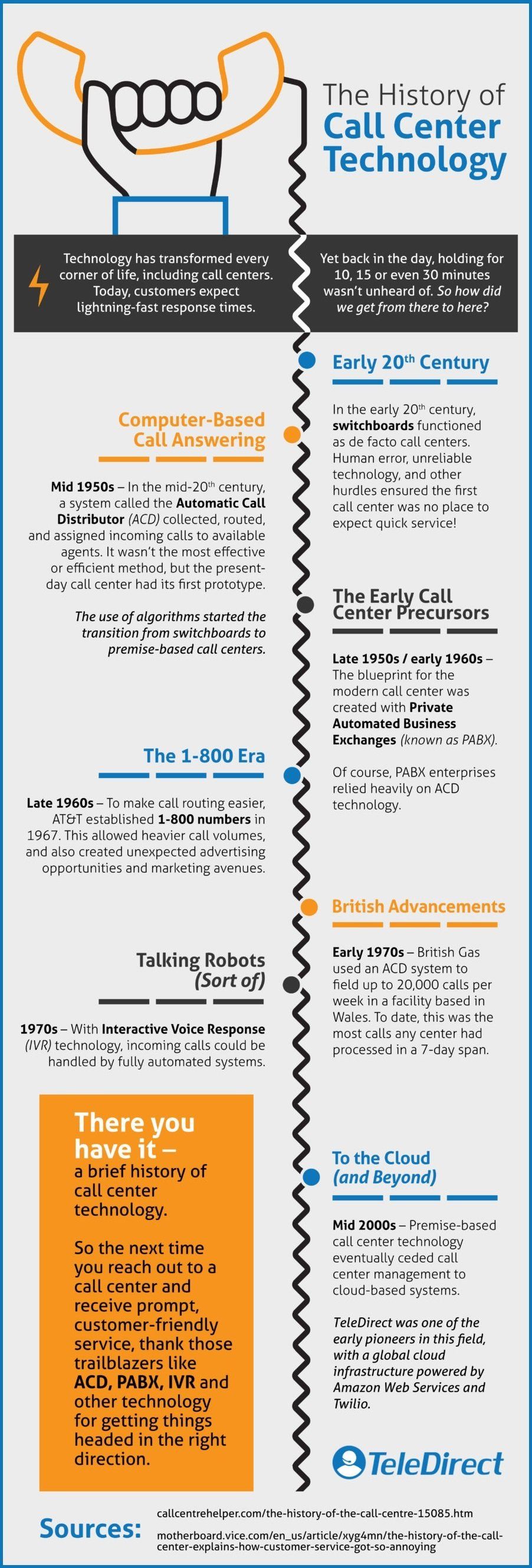

Trending Technology Simplifies Debt Collection

New Technology Has Improved Analytics,

Compliance and More

Is technology a good thing or a bad thing? It depends on who you ask. But when it comes to debt collection, it’s most definitely a good thing!

Thanks to technological advancements, debt collectors are able to contact more consumers and recover more funds than was ever thought possible a few decades ago. We now have better communications and consumer access systems, stronger analytics, robust compliance solutions, and improved security features.

All these tools streamline the debt collection process and make recovery simpler and easier.

Can We Talk?

New communication technology allows collection agents to contact increasing numbers of consumers in a fraction of the time, and in a consumer-friendly manner.

For instance, technologies such as voicemail drops send ringless messages so that consumers can respond on their own timetables. Contact strategies can also be automated in accordance with a consumer’s preferred mode of communication.

For ease of payment, collection agencies now offer multiple options, including online portals and mobile payment apps.

What’s in

Your Data?

Improved data analytics allow us to learn more about our consumers and their payment behaviors.

For example, we can identify the best time to contact a particular consumer, resulting in more efficient and effective calls. We can also use this data to determine the time of month when he or she is most likely or able to make a payment.

In addition, analytics can be used to create customized incentives, in order to keep a high-risk account from becoming delinquent. And they can also be used predictively to identify and flag high-risk consumers based on their profile or credit history.

Navigating the Compliance Minefield

The regulatory environment for medical debt collectors (in particular) is both complex and ever-changing. As a result, it can quickly become a minefield for the inexperienced or untrained.

Because they have access to both sensitive financial data and patient records, they must increasingly rely on advanced technologies to ensure strict compliance with HIPAA, as well as the Fair Debt Collection Practices Act (FDCPA) and all other federal and state regulations.

Compliance management technology allows debt collectors to detect, investigate and address any potential compliance issues. The reports that are automatically generated help analyze compliance with all the various aspects of consumer financial regulations.

Robust Security Controls

In addition to improved data analytics and compliance technologies, robust security controls protect consumer data and deter cybercriminal activity. As cybercrime becomes increasingly sophisticated, recent technological developments have also advanced to ensure consumer data remains secure.

The next generation of cloud technology, IoT security and even artificial intelligence are now being used by collection agencies to offer their clients both legal protection and peace of mind. And redundant virtual computer servers provide daily backup of data.

--Article Continues Below--

At CBSI

As “The Collection Agency That Cares,” we at CBSI know the importance of pairing empathetic and persuasive collection agents with the right technological tools, to make the collection process faster and more productive.

- We use proprietary data analytics tools to examine consumers’ payment behaviors, so we can optimize our recovery strategies. The end result for you is a much improved cash flow.

- We score each account according to its collectability, to ensure maximum results for our clients.

- We “scrub” our data for bankruptcies, deceased individuals and litigious consumers.

- Our contact systems are directly connected with USPS to ensure addresses and phone numbers are accurate and current.

- Our custom-made compliance management system enables us to respond proactively to the constantly changing regulatory environment.

- Our cutting-edge security tools incorporate the latest physical and firewall technology to keep sensitive consumer data stored safely.

Recent Posts

Share On: