Understanding the Fair Credit Reporting Act – and Proposed Changes

How Collection Agencies Ensure

FCRA Compliance

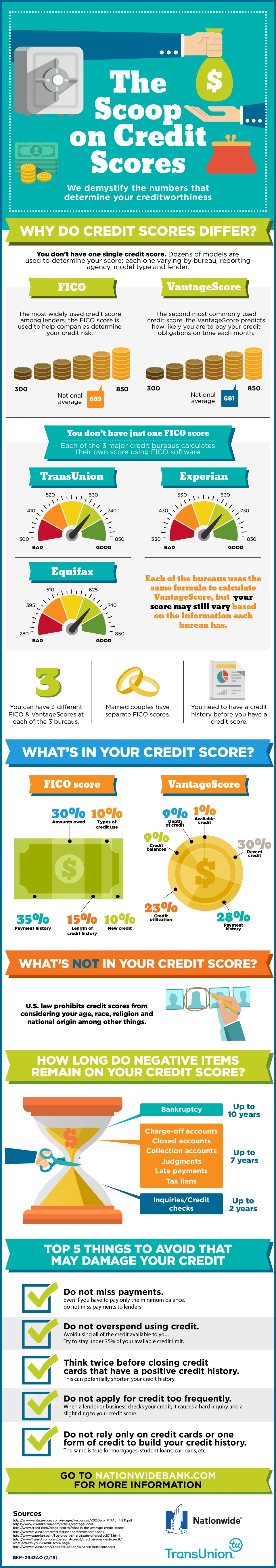

Credit reports are used not only to determine a consumer’s eligibility for a loan or credit card, but also to qualify him for a job, insurance or residential lease. The information reported to credit bureaus can impact both the consumer’s credit rating and livelihood.

So having an error-free credit report is crucial. To address this need, the Fair Credit Reporting Act (FCRA) was passed in 1970. Over the years, there have been several modifications to the original act; the most recent is currently awaiting approval by the Senate.

Let’s look at how the current FCRA applies to debt collection, as well what the proposed changes would mean.

FCRA Basics

The FCRA is designed to protect consumer privacy, ensure that information supplied to the credit bureaus is accurate, and offer consumers a means for disputing inaccurate data. As furnishers of consumer information to credit bureaus, debt collectors have specific responsibilities under the FCRA’s “Furnisher Rule.”

FCRA Violations

One of the objectives behind the proposed changes to the FCRA is to reduce the number of violations. Some of the most common include:

- Furnishing and reporting old information, or reporting an account as active when it was closed by the consumer.

- Mixing consumer information because of identical or similar names or similar Social Security numbers.

- Failing to follow FTC guidelines for handling disputes.

- Pulling a consumer credit report for an impermissible purpose (e.g., to determine the amount of assets before filing a lawsuit).

- Providing consumer information to unauthorized persons or businesses.

Specifically, they must:

- Provide information that is accurate and complete, and

- Investigate any consumer disputes pertaining to the accuracy of information they provide.

Ensuring Accuracy

It is illegal for debt collectors to furnish consumer information which they know or "have reasonable cause to believe" is inaccurate. Ensuring the accuracy of consumer information involves several steps. These include:

- Establishing policies and procedures to verify the identity of the consumer;

- Establishing controls to ensure the integrity of consumer data;

- Maintaining consumer records for a reasonable amount of time;

- Providing the date of the consumer's original delinquency and establishing procedures to prevent re-aging of accounts and duplicate reporting; and

- Correcting and updating information as needed.

Consumer Disputes

If a consumer disputes information provided by a debt collector to a credit bureau, the collection agency must:

- Advise the credit bureau that the information is disputed;

- Conduct a reasonable investigation of the dispute;

- Review all relevant information provided by the consumer with regard to the dispute;

- Report the results of its investigation to the consumer before the applicable expiration period;

- Promptly notify the credit bureau of the investigation's findings with regard to any inaccurate information that was furnished, and provide necessary corrections.

Proposed Changes to the FCRA

Last year, the U.S. House of Representatives passed the Comprehensive Credit Reporting Enhancement, Disclosure, Innovation, and Transparency Act, (known as the CREDIT Act). The bill now must be approved by the Senate.

While the CREDIT Act is primarily aimed at credit bureaus, data furnishers – such as collection agencies – will also be affected. The Act proposes several reforms, including:

--Article Continues Below--

- Implementing easier processes for correcting credit report errors and consumer appeals;

- Providing relief for student loan borrowers who have poor credit;

- Requiring that paid or settled medical debts be removed from consumer credit reports;

- Extending the time before medical debt may be reported and banning the report of any debt incurred for medically necessary procedures;

The CREDIT Act and

Medical Debt

The proposed changes to the FCRA as encompassed in the CREDIT Act specifically address medical debt in three ways:

- Credit bureaus are required to remove fully paid or settled medical debt from a consumer's credit report.

- Credit bureaus are prohibited from reporting debts arising from a medically necessary procedure.

- For all other medical debts, credit bureaus must delay one year before the debt is listed on a consumer's credit report.

- Restricting the use of credit scores for employment purposes;

- Reducing the amount of time any adverse credit information can remain on a consumer credit report (four years for delinquencies instead of seven years, and seven years for bankruptcies instead of 10); and

- Shortening the reporting periods for delinquencies from seven years to four years and for bankruptcies from 10 years to seven years.

Trust CBSI

At CBSI, we take FCRA compliance very seriously. That's why our compliance officer continually reviews our processes, ensuring that we proactively respond to the changing environment.

We extensively document all interactions with consumers. We've never been involved in an FCRA violation. And our compliance protocols ensure that we never will be.

Our collectors are highly trained to comply with ALL state and federal regulations, including FCRA, FDCPA and HIPAA. You need never worry about regulatory compliance when the professionals at CBSI have got your back.

Sources:

Featured Image: Adobe, License Granted

Consumer Finance Monitor

Boston University

InsideARM

Federal Trade Commission

Recent Posts

Share On: