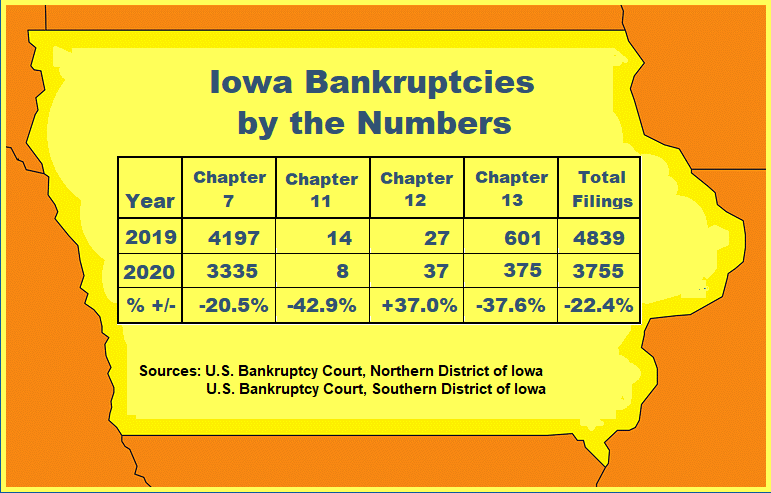

Bankruptcies Lowest in 35 Years, Despite COVID-19 Recession

Unemployment Was Way Up,

But Bankruptcy Filings Are Way Down

An economic downturn and increased unemployment typically result in more bankruptcies. But with last year’s COVID-related recession, the reverse occurred.

Given 2020’s economic climate, U.S. bankruptcy filings were expected to soar. They didn’t. Instead, the total number of bankruptcies filed fell by 28 percent – the lowest in 35 years.

Nothing Normal About It

The data defies normal economic patterns, according to researchers from both Harvard Business School and Columbia Law School. Historically, consumer bankruptcy filings mimic unemployment claims. As job losses increase, bankruptcy filings climb as well. This correlation was particularly strong during the economic recession of 2007-2009.

But even though 2020 witnessed the highest jobless rate since the Great Depression, consumer bankruptcies declined dramatically – and immediately – after a national emergency was declared. What’s more, the states with the largest increases in unemployment have seen the sharpest decreases in bankruptcy filings.

The statistics have baffled experts and left them searching for answers.

Record Number of

Chapter 11s

Chapter 11 business bankruptcies (used primarily by large corporations) showed the only increase over 2019. In fact, the largest corporations -- those with more than $50 million in assets -- filed in record numbers in 2020.

However, when small businesses are included, the total number of business bankruptcies was down.

Types of Bankruptcy

People are often surprised to learn that there are actually six different types of bankruptcy protection under the U.S. Bankruptcy Code:

- Chapter 7 Liquidation for individuals and businesses

- Chapter 9 Reorganization for municipalities

- Chapter 11 Reorganization for corporations, LLC’s or partnerships

- Chapter 12 Reorganization for fishermen and family farmers

- Chapter 13 Reorganization for individuals (including sole proprietors)

- Chapter 15 Cross-border Insolvency for foreign companies with U.S. debts.

Of these, Chapters 7, 11 and 13 are by far the most common.

In a Chapter 7 liquidation, debts are essentially wiped clean, with no obligation to repay. In 2020, more than 367,000 – almost 70 percent of all bankruptcy filings – were Chapter 7. As large as that number is, it still represents a 30 percent reduction compared to 2019.

Chapter 11 reorganization allows businesses to remain operational while restructuring their finances in order to pay their debts. Last year, more than 7,800 businesses (and a few individuals) filed for Chapter 11. This was the only bankruptcy type which showed a significant increase over 2019 – up by 29 percent.

(See sidebar, “Record Number of Chapter 11s.”)

Chapter 13 is a three-to-five-year repayment plan that allows individuals to reorganize their finances in order to retain certain assets, such as a home. In 2020, almost 153,000 consumers and sole proprietors filed Chapter 13, compared to about 283,000 in 2019 – down 43 percent.

Unraveling the Mystery

Several possible explanations have been offered as to why the 2020 bankruptcy rate did not parallel last year’s high unemployment:

Limited Access to Services

Social distancing restrictions and shutdowns may have limited consumers’ access to bankruptcy attorneys and (in some states) bankruptcy courts. As the pandemic worsened, many courts shifted to online proceedings in the interest of public safety. Despite no official stay-at-home orders,

most Iowa lawyers also chose to work remotely.

Too Broke for Bankruptcy

Some bankruptcy-eligible consumers may have lacked the financial resources needed to pay for a bankruptcy. The average Chapter 7 filing costs about $1,500 in attorney fees and court costs. This explanation is supported by the fact that consumer Chapter 7 filings did increase somewhat shortly after stimulus checks were distributed in mid-April.

Financial Aid

Government assistance through the $1.2 trillion CARES Act and the Paycheck Protection Program may have provided all the cash some consumers and small businesses needed to stave off bankruptcy during shutdowns. (Surprisingly, however, as these government programs expired toward the end of the summer, there was no upsurge in bankruptcy filings.)

--Article Continues Below--

Suspension of Collection Activities

State and local governments, federal agencies, and private businesses temporarily halted evictions, foreclosures, garnishments and other legal collection activities. The threat of foreclosure or eviction is a common trigger for Chapter 13 filings; last year consumer Chapter 13’s (that is, not including sole proprietorships) were about 60 percent below 2019 levels. Suspension of these collection activities, as well as general sympathy on behalf of the creditor, will likely play a key role in averting consumer bankruptcies for the time being.

Wake Me When It’s Over

Economic uncertainty could be forestalling bankruptcies. Consumers may be waiting for the pandemic to end (when they’ll have a clearer economic picture) before they decide on whether or not to file for bankruptcy.

Sources:

Featured Image: Adobe, License Granted

Epiq AACER (Automated Access to Court Electronic Records)

Recent Posts

Share On: