Love and Debt: What You Should Know

Certain Debts Can Be a

Romantic Roadblock

Jose was so in love with Ingrid that he gladly assumed payment of her debts. In fact, he considered it “a privilege” to be able to assist her in such a way.

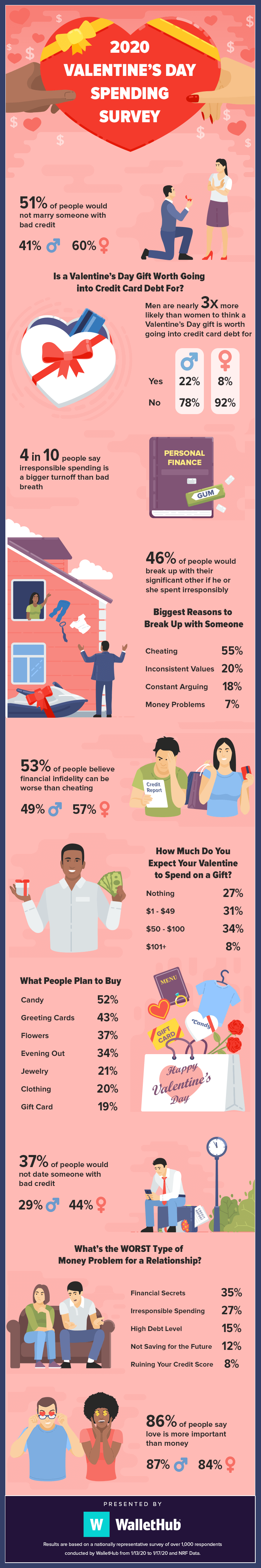

Most people don’t feel that way. In fact, according to a 2020

Wallethub survey, 51% of all respondents -- and 60% of female respondents -- would not marry someone who has bad credit. (Forty-four percent of women would not even date someone with bad credit.)

Relationship Deal Breaker

Credit card debt was the biggest turnoff, with more respondents citing that as a red flag. Irresponsible spending was found to be worse than bad breath as a relationship killer. Around 46% of the Wallethub respondents indicated they’d break up with a significant other who had reckless spending habits.

On the other hand, they were much more forgiving with regard to personal loans and medical bills. These debts apparently were not associated with character flaws or making poor financial choices.

—Article Continues Below—

Talking About Debt

Debt is not usually a first-date topic. But it is something that should be discussed before a relationship becomes serious. Couples considering marriage should bear in mind that the debt of one partner can become the debt of the other.

Buying Love?

Here are the five most extravagant Valentine's Day gifts ever received:

Number Five:

Chopard de Rigo Vision Sunglasses - $417,000. Decorated with 60 grams of 24K gold and 51 river diamonds.

Number Four: Montblanc/Van Cleef & Arpels Limited Edition Mystery Masterpiece Pen - $736,000. Decorated with 840 diamonds as well as more than 20 carats of emeralds, diamonds or sapphires.

Number Three: Bugatti Chiron Luxury Car - $4 million. With a 16-cylinder engine and quad turbo-chargers, this speedster goes from zero to 60 mph in 2.4 seconds.

Number Two:

Bulgari Necklace - $8 million. Custom designed by David Beckham for his wife Victoria and dripping with diamonds and rubies.

Number One: Gulfstream Jet - $20 million. In 2005, actor Tom Cruise surprised his fiancé Katie Holmes with this little token of his affection. (Alas, they divorced seven years later.)

Source:

Catawiki

Both parties should explain their debts, how they accumulated them, and how they’re handling them. This conversation can be uncomfortable, but it’s necessary if you want your relationship to move to the next level. If one person has made irresponsible choices in the past, he or she should indicate how they’ve changed, so as not to drag down their future as a couple.

Communicating about your finances allows partners to stand in each other’s shoes and view the situation from his or her perspective. In the end, it usually brings couples together and makes the relationship stronger.

Correcting Financial Mistakes

Romantic partners can help each other get their finances under control through budgeting. A

budget provides clarity and engenders a sense of responsibility. You can start by looking at your monthly bank statements to see where cash flow can be improved and which expenses can be reduced or eliminated.

Then, using a simple 50/30/20 budget, divide your income to pay for needs (50%), wants (30%), and savings/debt repayment (20%). Start by paying off the smallest debts first; this provides a sense of accomplishment. Also, you may wish to alternate between debt repayment and savings in order to accomplish your most pressing goals.

Most people take about three months to get into their budget’s rhythm. But don’t’ be discouraged. It will definitely keep you on track as you work toward paying your debt. Not to mention the peace of mind you’ll have by knowing exactly where your money is going.

What’s more, creating and adhering to a budget shows your partner that you’re taking all the right steps to make yourself less of a financial risk.

Intangible Gifts from the Heart

Is your significant other is struggling to pay medical debts or pay down a car loan? Offering to help could be the best gift Valentine’s Day gift they’ll receive.

Of course, much depends on the status of your relationship. Proposing to pay off a credit card for someone you’ve only known a few months is never a good idea. In fact, paying credit card debt is best left to couples who are committed for the long haul.

But unforeseen medical debt is a whole other situation. If your partner is stressed out about his or her inability to cover medical expenses, a little financial assistance could be a very romantic gesture.

Even if you can’t afford to pay off the entire balance, reducing the principal amount could go a long way toward warming your beloved’s heart.

Recent Posts

Share On: