Debt After Death: Who Pays?

Debts Don’t Die

With the Deceased

While most of us choose not to think about it much of the time, death is a fact of life.

But what happens to a person’s debts when he dies? As a healthcare provider or other creditor, how can you make sure you get paid?

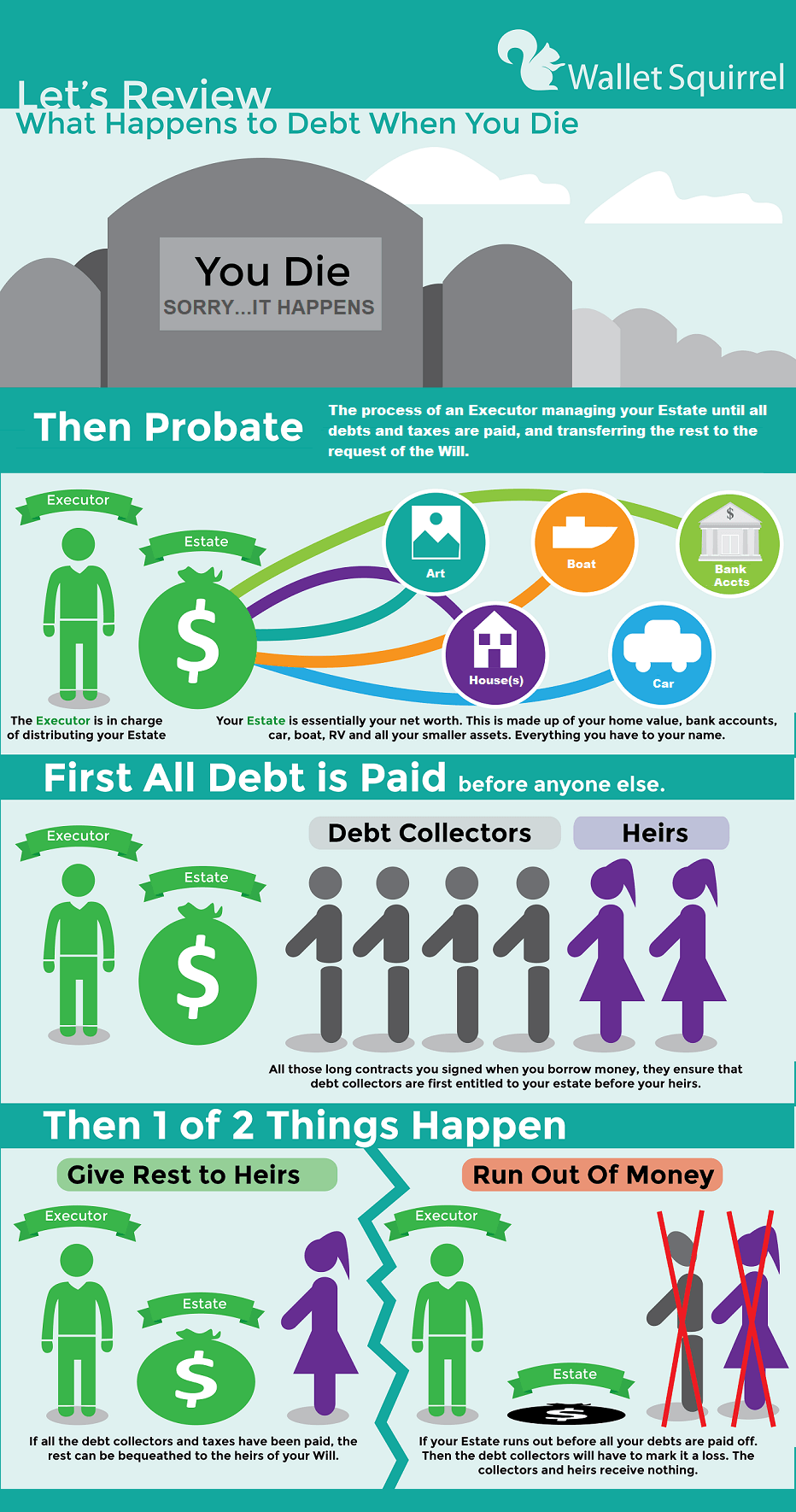

Upon death, a consumer’s debts become the responsibility of his estate. The estate’s executor is the person charged with using the deceased’s assets to pay off his current bills and all other debts.

This process could be as quick and easy as writing checks from a bank account, or as long and complex as selling a home or other property to get the necessary funds. Either way, it’s an important part of probating the estate.

The Solvent Estate

When the consumer’s estate is

solvent , there are sufficient assets available to cover all debts after his death. In other words, the total value of everything he

owned exceeds the total of everything he

owed.

While most of the decedent’s estate must be probated, there are certain assets that are excluded from the process, such as:

- Property that is jointly owned with someone else,

- Retirement accounts with designated beneficiaries,

- Life insurance with designated beneficiaries, and

- Trusts

The executor would have no control over these assets.

The Insolvent Estate

If there are not enough assets in the decedent’s estate to pay off his debts, the estate is considered insolvent. (The total of everything owed exceeds the total value of everything owned.)

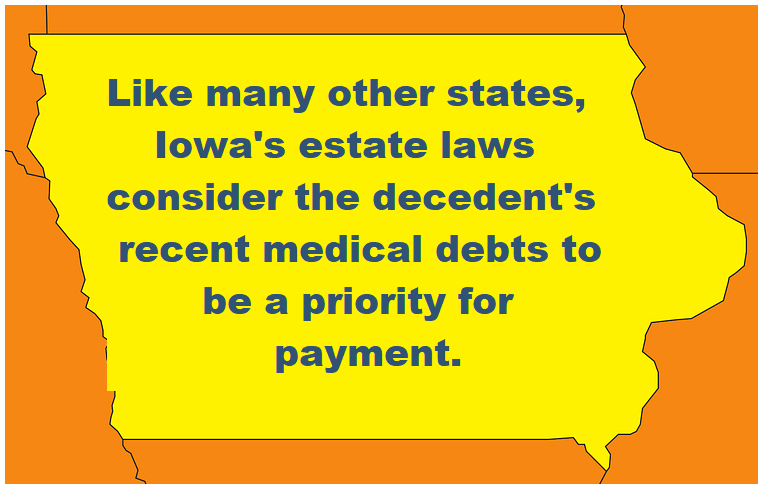

In that case, the executor must prioritize the deceased person’s debts in accordance with federal and state law. Every state has its own probate laws that direct how someone's final affairs are to be handled. This includes the priority of debt payment.

In Iowa, the priority for payment is as follows:

- Court and administrative costs

- Funeral and burial expenses

- Federal taxes

- Recent medical care expenses

- State taxes

- Medicaid reimbursement

- Employee wages

- Support payments

- All other claims

You will notice that medical debt takes precedence over other claims. In Iowa, this debt must pertain to the “decedent’s last illness.” The executor is to pay these and other "priority" debts first. Other creditors would then be allocated a share of any money that's left over.

Filing a Claim Against an Estate

The estate executor is responsible for notifying creditors of the consumer’s death. Typically, they also notify the big three credit bureaus (Experian, TransUnion and Equifax), so the account can be flagged as “Deceased: Do not issue credit.”

After receiving notice, creditors usually have six months to file claims against the estate. Here’s how:

--Article Continues Below--

- Locate the correct probate court. The executor can file for probate in the county where the deceased person lived or in the county where the deceased owned property.

- Gather documentation to confirm the debt AND to prove that the debt was still owed at the time of death.

- Complete the claim form. Some courts require that claims be completed and filed in person; others allow this to be done online.

- File the claim. Depending on the court, this may be done in person, online or by mail. Once filed, be sure to obtain a certified copy of the filing for your records.

OR LET US DO IT FOR YOU

If you’re already a CBSI client, we’ll gladly file the claim on your behalf. Not a client?

Contact CBSI today to take advantage of this and the many other debt recovery services we can offer.

Sources:

Featured Image: Adobe, License Granted

Nerd Wallet

The Balance

Iowa Probate Code

Recent Posts

Share On: