Why Age of Accounts Matters

The Older the Debt,

the Less Likely You’ll Collect

The sooner you send past-due accounts to collections, the higher your return.

Alternatively, the longer you wait, the less likely the debt will be collected. In fact, some studies indicate that your chance of collecting within the first 60 days is 90%. Wait till over 90 days, and your chance drops to 50%. Over 180 days, and you have a 20% chance of collecting.

If you wait for more than a year, you’ll probably get nada.

What Makes Older Balances So Hard to Collect?

The Commercial Collection Agency Association (CCAA) of the

Commercial Law League of America

agrees that the probability of collecting on a delinquent account drops sharply with the length of delinquency.

No doubt about it: When it comes to debt collection, time is not your friend.

Why are these older balances so hard to collect? Many reasons, such as:

- Patients have forgotten about the services rendered and question whether the debt is legitimate.

- Patients assume insurance covered the entire cost of services (or believe it should have).

- Patients file for bankruptcy.

- Patients move and cannot be located.

- Patients' financial records are misplaced.

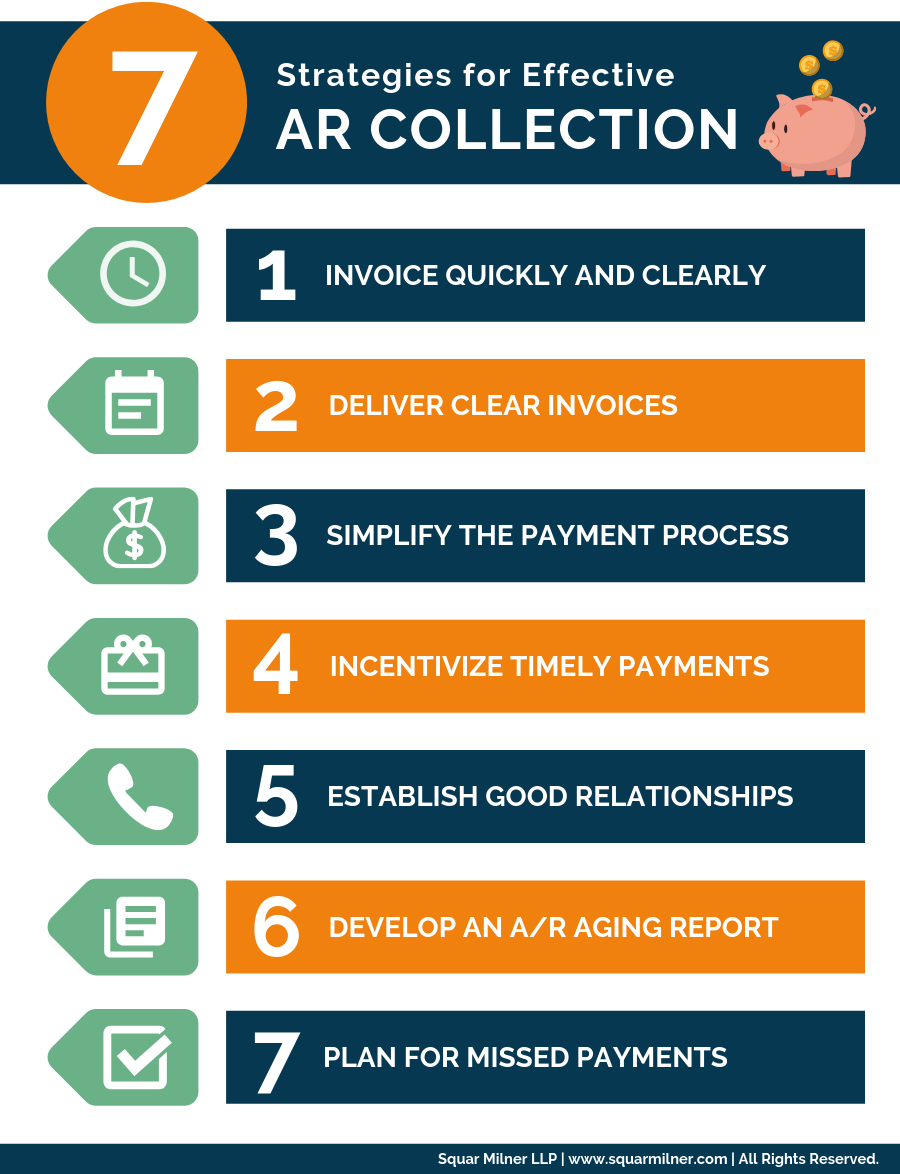

The Power of the Gentle Reminder

You’re much more likely to collect a debt by pursuing payment within the first 30 days. After that, past-due accounts are best left to medical collection experts specifically trained in debt recovery on older accounts.

By keeping a close eye on the age of your accounts receivable, you can identify those patient accounts that should be pursued first. Then deal with the problem head-on, by being straightforward but not aggressive.

Gentle reminders can be quite effective during the first 30 days of delinquency. (After all, people do forget.) Quick and courteous debt collection practices are more likely to result in payment than waiting for a patient to send you a check.

--Article Continues Below--

The Smaller, the Shorter

Generally speaking, the smaller your healthcare practice, the shorter your age of accounts should be. Large healthcare providers can sometimes handle keeping older debts on the books (at least, temporarily) because they have more revenues and assets to draw from. Smaller providers, however, rely more heavily on their accounts receivable to maintain their cash flow.

A recent study by the

National Federation of Independent Business indicates that the small business receivables cycle has increased 30% over the last five years. It’s now about 48 days.

Do the Math

Calculating your average collection period will give you a clear idea of how long it typically takes for your business to receive payment for services. Here’s the standard formula:

Days in Period x Average Accounts Receivable / Net Credit Sales

= Average Days to Collection

Let’s define each of the basic elements:

Days in Period

— The number of days you choose for your calculation can be 365 or 90, or whatever works best for you. However, the other data in the formula must span the same number of days.

Average Accounts Receivable — Calculate your total accounts receivable at the beginning of your Days in Period and the total accounts receivable at the end of your Days in Period. Add these two numbers and then divide the sum by two.

Net Credit Sales — This figure is the total amount of your facility’s gross sales minus the total of all returns during your Days in Period.

Here’s an example that uses 365 as the Days in Period:

ABC practice had $80,000 in A/R at the beginning of the year and $90,000 in A/R at the end of the year.

So its Average Accounts Receivable over the course of the year would be $85,000.

($80,000 +$90,000 divided by 2 = $85,000)

Over the same period,

its net credit sales was $600,000.

Plugging these figures into the formula, we get:

365 x $85,000 / $600,000 = 51.7

So it takes ABC practice an average of 51.7 days

to collect on an account.

According to The Commonwealth Fund, 79 million Americans are struggling with medical debt. When you partner with CBSI, you’re working to help alleviate that burden.

And by sending overdue accounts to us early in the process, you’re optimizing you’re window of opportunity for maximum recovery. AND you're freeing up your valuable time.

So you can get back to what you do best – providing exceptional health care.

Sources:

Featured Image: Pixabay

Credit Research Foundation

Patriot Software

The Balance

The Commonwealth Fund

Recent Posts

Share On: