Helping Your Patients Dig Out of Medical Debt

Are Your Patients Struggling with

Outstanding Medical Debt?

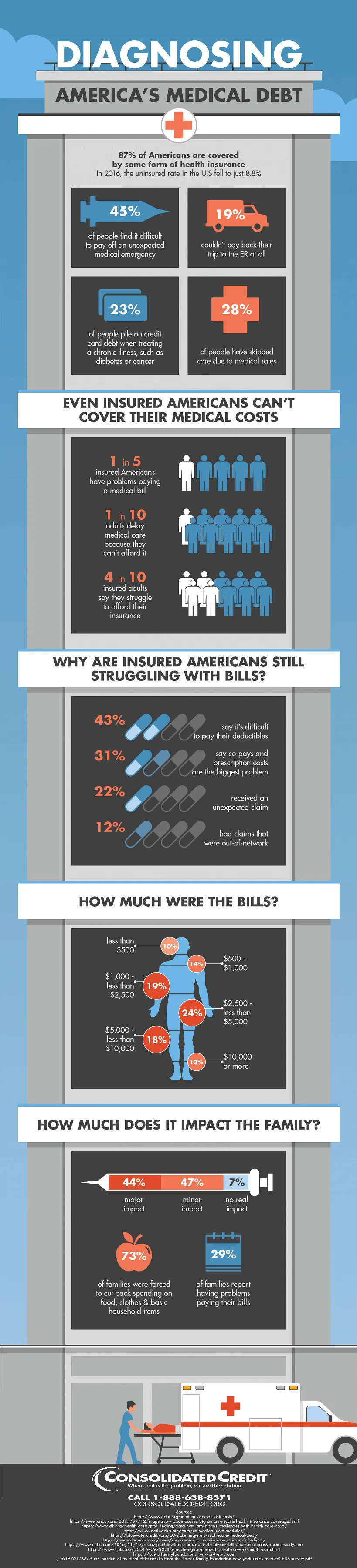

Medical debt is on the rise for American families.

In fact, according to a 2017 TransUnion Healthcare study, by next year, 95 percent of all patients will fail to pay their bills in full. Other medical debt statistics are just as alarming:

- Over the last year, Americans have borrowed approximately $88 billion to pay for health costs and medical care.

- Twenty-five percent of Americans have foregone medical care because of the cost.

- Medical debt is the number one reason people in the U.S. file for bankruptcy.

- The average American consumer spends

more than $10,000 a year on health care.

What's Going On?

The two primary reasons for this sharp rise in medical debt are 1) higher deductibles and 2) increased patient responsibility. For instance:

- According to the

National Center for Health Statistics, 47 percent of all persons under age 65 were enrolled in a high-deductible health plan (HDHP) in 2018. (The IRS defines an HDHP as any health plan with a deductible of at least $1,350 per individual or $2,700 per family.)

- Patient financial responsibility increased by 67 percent over five years for persons with commercial insurance plans. In 2017 alone, average out-of-pocket costs increased 11 percent — from $1,630 to $1,813.

Obviously, when patients are unable to pay their medical bills, healthcare providers are challenged to pay their employees, pay their own vendors and keep their operations running smoothly.

What Can You Do?

As a medical provider, what can you do to help your patients pay their healthcare bills BEFORE the debts become outstanding? Here are a few suggestions:

--Article Continues Below--

- Be willing to negotiate. If you know a patient is having financial trouble, consider reducing the total bill or negotiate a payment plan.

- Refer them to assisting agencies. Maintain a database of local charities and assistance organizations who can help your patients with their medical bills. Also, refer them to food pantries and utility assistance programs. Not only will they know you care, but it could free up some of their resources to pay medical bills.

- Offer a discount healthcare program to your self-pay patients. The

Consumer Healthcare Alliance can show you how.

We Can Help

If you’re struggling with outstanding patient balances, it’s time to bring in the professionals. The nature of the medical industry requires that you offer compassion along with your services. And maintaining good relations within the community is essential.

One way to do this while still collecting money owed to you is to partner with a healthcare debt collection agency like

CBSI. By working with a collection service that specializes in medical debt, you’re placing this difficult task into the hands of compassionate experts.

Professional medical debt collectors utilize best practices in order to reclaim your money without jeopardizing patient goodwill.

Our healthcare collection expertise and affordable rates for any size practice make CBSI the ideal debt-recovery partner.

Recent Posts

Share On: