Time to Send an Account to Collections? Look for These 4 Signs

How Do You Know When It’s Time to

Send an Account to Collections?

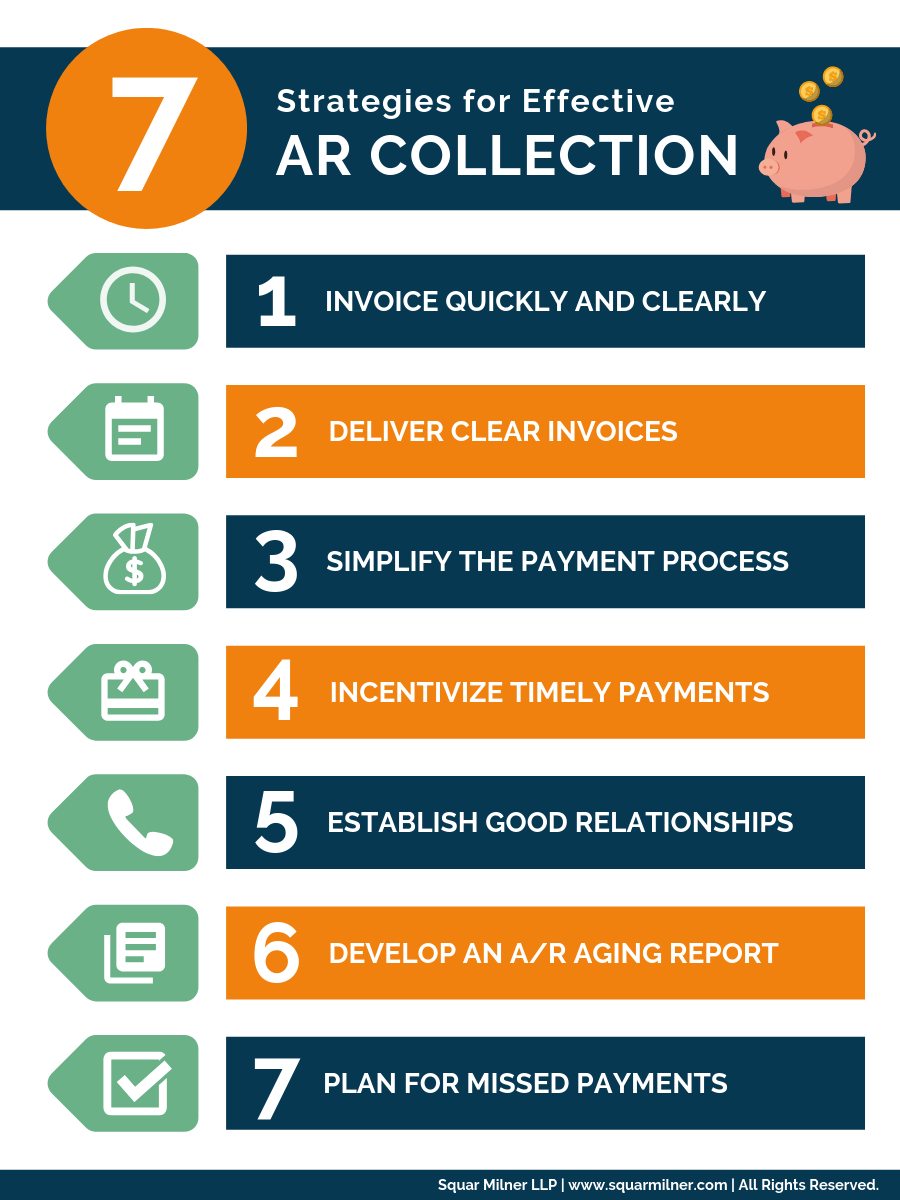

Cash flow is the lifeblood of your company. If it’s interrupted because of unpaid invoices, you may not have the necessary funds to keep your business operational.

Which could mean YOU can’t pay your staff, suppliers, or other expenses. You can be slapped with late fees, and your reputation can suffer. But how do you know when it’s time to send an account to collections?

Common sense dictates that, if a consumer or patient cannot afford to pay all of his creditors on time, then someone is not going to be paid. The key is to determine if this financial shortfall is a one-time occurrence or a symptom of a bigger problem that requires immediate action on your part.

Here are four signs to look for when determining which accounts should be placed into collections:

The Account Is More Than 90 Days Past Due

If the consumer or patient has always made timely payments and is now suddenly more than 90 days past due, you may have a problem. Especially if their promises to correct the situation are not kept.

Turning their account over to a reputable collection agency will not only save you money, it could very well keep your consumer relationship intact. Be sure to select an agency that will work with (not against) the consumer or patient and that has a reputation for being friendly and caring.

The Consumer Won’t Return Your Calls

If a consumer or patient refuses to return your calls after repeated attempts to contact them, placing the account in collections may be your only option. If a client who owes you money has suddenly become unreachable, you’re almost surely headed for trouble. (Returned mail could be another red flag.)

If your loyal patient has suddenly become a ghost, it may be time to bring in the pros. Professional debt collectors are experts in collecting unpaid debts. They’re skilled at streamlining the whole process; they have access to data software, databases, and tracking systems.

Perhaps even more important, they’re trained to comply with the ever-changing rules and regulations that govern debt collection.

They can get your patient to the table because it’s what they do for a living.

The Consumer Has Stopped Using Your Services

If a previously faithful patient/consumer owes you money and has now stopped using your services, something’s changed. You should be on the alert, even if the account is not overdue. If he or she no longer requires your goods or services, there’s no incentive on their part to pay what’s owed.

Once such an account reaches the 90-day past-due mark, you’ll want to send it to collections.

--Article Continues Below--

The Account Has Several Unresolved Disputes

Unfortunately, consumer or patient disputes are a reality of conducting business. And there are several legitimate reasons for failure to pay a debt in full:

- They could have received the wrong (or damaged) items.

- They could be genuinely dissatisfied with the product or service.

- They may believe they were entitled to a discount.

- Patients can often believe that their insurance should have paid more of their medical bill.

These situations can usually be settled rather quickly and to everyone’s satisfaction.

But there are also times when a patient or consumer will refuse to cooperate or settle the dispute, and it continues to age. If you then find that more of this person’s invoices are becoming disputed, you have a problem – one that’s not related to the disputes. Rather, he or she is simply using the disputes as a way to justify non-payment.

Again, this is the time when you need to enlist the help of a reputable collection agency – one with a proven track record in dispute resolution and debt recovery.

The Bottom Line

Using the aforementioned warning signs as a guide, your internal collection efforts should be able to identify which accounts to place in collections. You’ll want to make this determination as early as possible. (Some patients/consumers will no doubt display more than one of the warning behaviors.)

A pro-active approach is always best. The sooner you turn these accounts over to a reputable debt collector, the sooner you’ll realize a cash return. And the sooner you can get back to operating a profitable business !

Recent Posts

Share On: