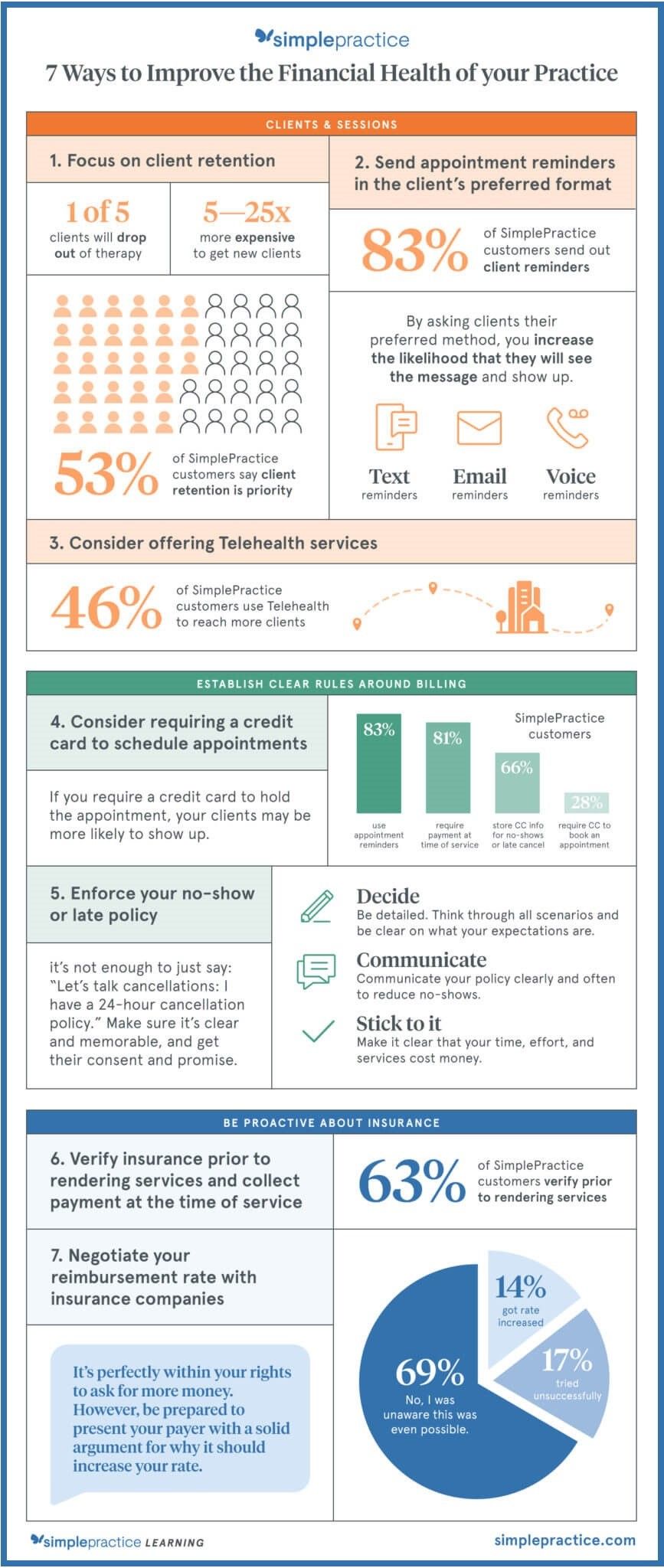

This Year, Resolve to Improve Your Practice’s Financial Health

Think of All You Could Do

With Recovered Funds

What could your medical practice do with all the money recovered from overdue accounts? Hire more staff? Invest in new technology? Pay your suppliers? Expand your facility?

By retaining a medical collection agency to recover payment on the past-due accounts, you’re taking the first step toward boosting the health of your business. So you can continue to provide exceptional patient care without a hitch.

Healthy Finances

Here are just some of the ways a professional collection agency can enhance a medical center’s finances:

Primary Care Practices

Still Feeling the Pinch

A recent survey from the Larry A. Green Center, in partnership with the Primary Care Collaborative, revealed that the number of primary care practices reporting layoffs, skipped salaries, and temporary closures has remained constant since the onset of the COVID pandemic.

Earlier, a 2020 Medical Group Management (MGMA) survey had reported that medical practices averaged a 55% decrease in revenue and a 60% decrease in patient volume directly related to the pandemic.

Source: Fierce Healthcare

- Debt collection is all collection agents do. It’s their livelihood. By using proven collection methods they maximize recovery on your overdue accounts. That’s revenue you can use to ensure continued smooth operation of your practice – or to invest in your future growth.

- Freeing up your valuable time and resources allows you and your staff to focus on addressing your patients’ medical needs.

- Sometimes partnering with a professional collector is all that’s necessary to prompt consumers for payment. Past-due accounts are quickly resolved, and the valuable patient relationship is preserved.

- Medical debt collectors utilize advanced technology and tools your practice or facility most likely does not possess. They can remain in continual communication with delinquent accounts through various channels.

- By recovering debt quickly, you’ll significantly reduce the number of bad debt write-offs at the end of the year.

The Risk of Going Solo

On the other hand, attempting to collect these accounts on your own is fraught with potential financial (and legal) pitfalls.

–Article Continues Below–

The Compliance Minefield

The federal and state regulatory environments are ever-changing; compliance can be a minefield for the inexperienced.

A reputable consumer collection agency will know the ins and outs of compliance. They continually review their processes and work to ensure their collectors are highly trained in accordance with all state and federal regulations.

Medical Collections

Are Different

Medical practices face unique payment challenges compared to businesses in other service industries. For example:

- Patients often fail to prioritize their medical bills, especially if the bills are unexpected and not in the budget.

- The cash flow that healthcare practices depend on comes from both patients and insurance carriers, so providers must plan on multiple payment sources for a single invoice.

- The sensitivity of the doctor-patient relationship necessitates that medical debt collectors possess exceptional soft skills, as well as a firm understanding of the medical billing process.

Getting Professional Support

In addition, without professional help, you’re far less likely to recover monies owed to you.

Skilled debt collectors are trained negotiators who can handle your patients with tact and treat them with respect. Reputable collection agents will educate your patients and work with them – not against them -- to resolve the outstanding debt.

What’ve You Got to Gain?

At CBSI, our collectors are experts in handling sensitive financial matters. Many of them have also had an account in collection at one time or another, so they understand it’s not a situation most people choose (particularly where medical bills are concerned).

At the same time, we recognize that you have the right to be paid. A medical practice without a secure cash flow will not remain in business for long.

We at CBSI have recovered almost a quarter of a billion dollars for our clients! It’s what we do all day long. You really have nothing to lose (and a whole lot to gain) by retaining us to collect on your past-due accounts.

Why not make 2023 the year you resolve to improve your practice's financial health?

Sources:

Featured Image: Adobe, License Granted

Forbes

Healthworks Collective

Nolo

Recent Posts

Share On: